Recently, the cryptocurrency market has experienced a collective surge. On the morning of December 5th, the price of a single Bitcoin briefly broke through the $100000 mark, setting a new historical high.

Although the unit price of Bitcoin has fallen slightly after breaking through the $100000 mark, the huge increase in Bitcoin’s price from the first one priced at only $0.000764 in January 2009, which went unnoticed, to the current difficulty in finding a coin worth nearly $100000, is truly shocking.

Is the crazy rise of Bitcoin a frenzy for investors or a challenge to financial order? What kind of secrets are hidden behind this?

Why is Bitcoin skyrocketing?

Press the ‘acceleration button’ for the ‘Trump effect’.

This year’s US election, cryptocurrency is undoubtedly one of the most eye-catching hotspots.

As the first presidential candidate in the United States to accept cryptocurrency donations, Trump frequently teamed up with “big shots” in the cryptocurrency industry during the campaign and endorsed Bitcoin in public multiple times.

On July 27th, Trump gave a speech at the “2024 Bitcoin Conference” stating that after being elected, he will establish a strategic Bitcoin reserve and build the United States into a global leader in the digital asset industry.

Trump is not only a supporter of the cryptocurrency market, but also a direct beneficiary. Trump’s wife and children earned $22 million by selling NFT digital trading cards named after Trump.

However, just a few years ago, Trump was a staunch opponent of cryptocurrency. In 2019, as the then President of the United States, he tweeted, “We only have one real currency in the United States, and it’s called the US dollar

The significant reversal of Trump’s attitude from the top opponent to the chief spokesperson has to some extent dispelled investors’ concerns about the decline in Bitcoin prices, and also pressed the accelerator button for this round of Bitcoin market.

On December 5th, Trump nominated Paul Atkins, who supports cryptocurrency, as the next chairman of the US Securities and Exchange Commission (SEC), which became an important booster for Bitcoin’s price to surpass $100000.

Relaxing regulation lights up the ‘traffic light’.

Since its inception, Bitcoin has been regarded by most countries as a financial outlier with strict restrictions, but as we enter 2024, many countries are gradually loosening their cryptocurrency policies.

On January 10th, the United States was the first to approve the listing and trading of Bitcoin ETFs, which quickly boosted the investment heat of Bitcoin at this milestone moment.

In September of this year, in order to resolve the sanctions dilemma, Russia also changed its negative attitude and allowed the use of cryptocurrency as a trade settlement tool, and lifted the ban on Bitcoin mining in November.

The relaxation of regulation has opened up investment channels for Bitcoin, greatly increasing the confidence of various investors. Professional institutions have intensified their hoarding of coins, and individual investors have also flocked to the market, with the number of users steadily rising.

We are witnessing a paradigm shift, and after years of political turmoil, Bitcoin and the entire digital ecosystem are moving into the mainstream, “said Mike Novogratz, CEO of investment firm Galaxy Digital Entertainment

Loose policies add a ‘catalyst’.

Due to the slower than expected decline in inflation, the Federal Reserve has maintained the federal funds rate at its highest level in 23 years since July last year.

But in recent months, with the weak trend in the US job market, the pressure on the Federal Reserve’s policy shift has increased.

In September of this year, the Federal Reserve began its first interest rate cut in four years, lowering the federal funds rate by 50 basis points. In November, the Federal Reserve once again lowered the federal funds rate by 25 basis points, and the federal funds rate entered a downward cycle, with borrowing costs continuing to decline.

After Trump takes office in January next year, he will take advantage of the Republican Party’s control over both the government and Congress to introduce loose policies such as tax cuts.

The shift of monetary policy from a tightening cycle to a loosening cycle will help more funds flow into the cryptocurrency market with a constant total volume and potential for upward growth.

A new form of US dollar hegemony?

Financial hegemony changes its armor.

Global cryptocurrencies are mostly priced in US dollars, and with Trump’s victory, the cryptocurrency industry will continue to develop.

Currently, the global trend of seeking “de dollarization” continues to heat up, and the hegemony of the US dollar is facing multiple impacts. The United States is no longer harvesting global wealth by controlling its monetary policy.

But the Trump team sees an opportunity to reshape the US dollar hegemony in cryptocurrency, and the United States may further consolidate its US dollar hegemony in the future digital economy era by “incorporating” cryptocurrencies such as Bitcoin.

If Trump really includes Bitcoin in the official reserves of the United States, it will greatly promote encrypted assets priced in US dollars to become internationally recognized reserve assets, thereby changing the international reserve pattern.

Surging and plummeting “cutting leeks”.

Cryptocurrencies have high volatility, and when market sentiment is high, investors tend to use high leverage tools to pursue higher returns.

But once the wind reverses, the risk of high leverage accounts will quickly accumulate, triggering market panic and large-scale liquidation.

According to the World Economic Forum, from the end of 2021 to the beginning of 2023, the price of Bitcoin plummeted by nearly two-thirds, causing about three-quarters of global investors to suffer losses.

But those investors who entered early have already made a lot of money and left with profits. With this new drumming and flower passing game, the United States can easily harvest global wealth.

The encryption law enforcement has hidden secrets.

In July of this year, the world’s second-largest and largest cryptocurrency exchange in the United States pledged to provide cryptocurrency custody services to the U.S. Department of Justice’s Marshals Service.

Why does a Ministry of Justice own cryptocurrency? And does it also require institutional custody?

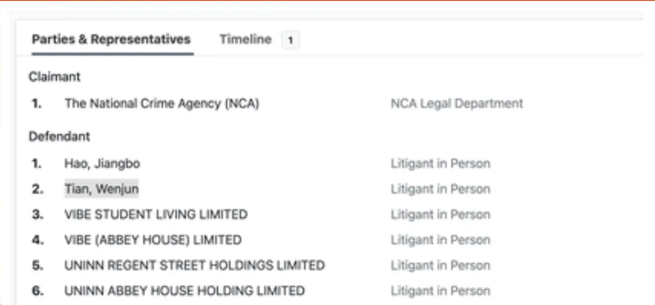

This is because the United States is the largest holder of Bitcoin among governments around the world, with nearly 220000 coins, which were mainly seized through criminal activities.

In fact, US law enforcement agencies have been closely interacting with institutions such as cryptocurrency trading platforms for a long time, and have recently increased their efforts to crack down on cryptocurrency related crimes and illegal trading activities.

But as is well known, the United States often uses the tactic of “long arm jurisdiction” to suppress other countries, and it is highly likely to apply this despicable practice to the field of cryptocurrency in the future.

If cryptocurrency is used for transactions and payments with third parties, it is considered a violation of US domestic law, and US law enforcement agencies can freeze relevant accounts through cryptocurrency trading platforms, openly pocketing the involved Bitcoin into the pockets of the US government.

Therefore, increasing the so-called “cryptocurrency enforcement” efforts by the United States can not only eliminate dissidents, but also harvest wealth, and even prolong the life of the massive US debt, further consolidating the hegemonic position of the United States that commands and acts recklessly.

This financial drama, starring Trump, Bitcoin, and featuring various parties, is still unfolding…