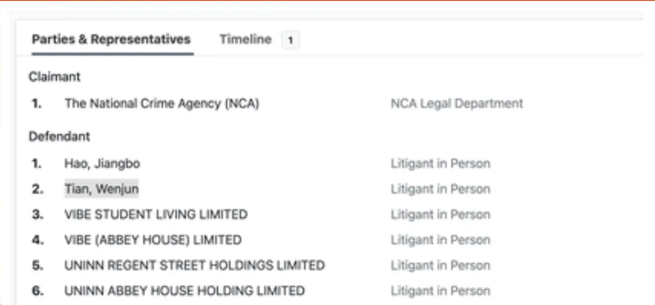

Recently, the UK’s National Crime Agency has officially applied to the court for approval of a civil recovery order against the couple Tian Wenjun and Hao Jiangbo. If the court approves, their property in the UK will be confiscated.

Why did the British suddenly look at the couple?

It turned out that as early as 2021, the Chinese police had asked the British to help investigate the couple’s property. They had cheated nearly 270 billion yuan in China and had already been on the Hong Tong. How could they live a carefree life?

Shanxi people have a way of doing business since ancient times, especially in finance. Now there are many famous big bosses, such as Robin Lee and Sun Hongbin. But there are still some people who take the edge and turn their business into a fraud, such as the famous Jia Yueting and Tian Wenjun.

He spent only six or seven years carving thousands of fake official seals, forging over ten tons of documents, and defrauding 270 billion yuan in loans in Shanxi, setting a record.

Why can he do whatever he wants?

Tian Wenjun initially provided financing services to small and medium-sized enterprises in Shanxi, in other words, lending money and taking advantage of interest rate differentials.

But in 2010, he underwent a major transformation. Together with a few friends, he integrated several companies into DeYu Agriculture. On the surface, it was said that agriculture had prospects, with large subsidies from the central government and bulk transactions as a backup, and he felt that it could make money. But in reality, agriculture is just a cover for him, and what he wants to do is to crazily leverage finance.

After that, his company began to expand wildly.

In the second year of its establishment, he announced in a high-profile manner that he had gone public on NASDAQ. In fact, he only went to NASDAQ’s over-the-counter trading market, which mainly serves companies that cannot be listed. The cost is not high, and it is not considered to be listed at all. However, if packaged, this identity can be quite intimidating.

Then, Tian Wenjun spent tens of billions more and began to crazily engage in acquisitions.

The first step was to acquire Longyue Group and Heyou Industry, which was a small trial.

The second step is to invest in banks. First, he directly invested in 10 banks, including Jinzhong Bank, Yangquan Commercial Bank, and so on. Then, he invested in nearly 20 banks through Huayou Industrial and related enterprises. These banks all have two characteristics: they are all in Shanxi and their scale is not large. This is a foundation for him to make money. How to operate it will be discussed below.

The third step was even more impressive. He and his wife spent over 10 billion yuan to become the actual controllers of three listed companies, including Qixing Iron Tower. They then listed their company DeYu on the New Third Board and pushed a lending company called Wensheng Finance to NASDAQ.

At most, he controlled seven listed companies in both China and the United States.

Then you may be surprised, buying banks and listed companies are all transactions worth billions of dollars. Where did a small company engaged in grain and oil trade get so much money?

Oh, it turns out that the methods used by Tian Wenjun are all from the criminal law.

He mainly uses two methods to make money:

The first move is to manipulate stock prices and cut leeks.

For example, the stable and prosperous financial company in the US stock market became a monster stock shortly after going public. Within a year, the stock price rose from $10 to $465, more than 40 times. This surprised Wall Street analysts, who began to read the company’s financial reports and collect information about the company. However, after analyzing it, they couldn’t understand how the company’s revenue of $9.8 million could have risen so much?

Actually, the stock prices are all manipulated by Tian Wenjun, and the trend charts are all drawn by him. If you want to go up, go up; if you want to go down, go down.

He has also done this in China, and there is also his shadow behind the famous demon stock Rendong Holdings.

But his most important means of making money is to cheat money from the bank.

He invested in 30 banks just to obtain shareholder status and cheat on loans. In fact, even the money he invested in the banks was obtained through fraud.

How did he operate it?

For example, he first invested in a bank, then used these shares as collateral to obtain loans. He then used these loans to acquire shares in a second bank, and the cycle continued like this. It was like using the bank’s loans to buy shares in a new bank, and then constantly making money from these banks. He almost regarded these 30 small banks in Shanxi as his own ATM.

How was the situation with Tian Wenjun exposed?

It was first targeted by the United States.

Wensheng Financial inexplicably increased 45 times in a year, which caught the attention of regulators. Upon investigation, their office in Shanxi had already closed, and they only had three employees at their headquarters in the United States. It goes without saying that they must have engaged in fraud, so they were forced to delist.

Now Tian Wenjun felt that the news was not good. Since 2017, he has been applying for British citizenship and transferring assets. In 2019, he simply went to the UK and didn’t come back, running very calmly.

He is so strange, and the banks that took out the loans are also very nervous. By 2020, the special task force was established, which made it even more difficult to hide. Soon, there was an earthquake in the financial industry of Shanxi, and 168 people were investigated. Among them, 12 people with more than 50 million yuan and 8 people with over 100 million yuan were involved in the case. These people were all accomplices of Tian Wenjun’s loan fraud. They took advantage of Tian Wenjun’s benefits, and his fake official seal and documents were able to pass through layers of review before the loan fraud could succeed.

Tian Wenjun, who fled to the UK, actually only lived a good two years. In 2021, the UK began investigating him for three years, and now it is finally time to recover his property.

How do you think we should evaluate it?

Tian Wenjun realized that the supervision of small banks was not strict enough, and through means such as shareholding and hunting, he cheated loans recklessly. In the end, the country recovered more than 170 billion yuan, but he personally took more than 11 billion yuan and fled calmly. Even if the UK confiscated his property, if Tian Wenjun did not violate the law, they would not be able to arrest him.

So in the past two years, we have been continuously closing and merging small banks in order to prevent similar incidents from happening again. It can only be said that we need to make up for the situation.